Extracts from document

Extracts from document

To understand the NWE plan, a good place to start is the Plan Overview. Below are a few linked and marked highlights from this chapter.

- Emphasis in low dollar cost

- Economically Optimal Portfolio (EOF)

- EOF Resources

- Resource Mix 2025

- Role of natural gas

The establishment of a diversified generation fleet under its ownership and control further

solidifies both NorthWestern’s and Montana’s goal of owning generation, creating more

vertically integrated utility operations, and transitioning to capacity-based resource

planning to meet critical customer needs while maintaining a low-carbon emission

footprint. The resource initiatives and actions developed in this 2015 Electricity Supply

Resource Procurement Plan (“2015 Plan” or “Plan”) identify the critical future needs of

our portfolio including addressing significant capacity shortages. The Plan identifies how

to best meet the large capacity needs of the supply portfolio with least-cost, low-risk

resources and includes a set of action plans which the utility will implement on a going

forward basis. Key focus areas identified and developed in the Plan include:

- Capacity-based planning and determination of resource adequacy

- Co-optimization of hydroelectric and thermal resources

- Optimized new resource selection

- Resource flexibility, dispatch, and ramping capability

- Cost-effective integrated utility operations and planning

………

Preferred Resources

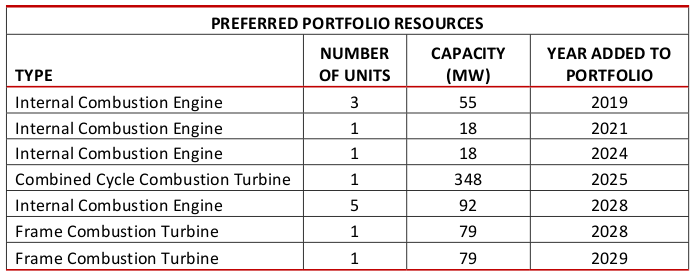

The evaluation of resource alternatives using a combination of optimal capacity expansion

methods and 20-year Net Present Value (“NPV”) of portfolio cost simulations has

produced a resource capacity plan to meet minimum levels of adequacy calculated through

loss of load probability analysis (Chapter 11). The Economically Optimal Portfolio

(“EOP”) is comprised of gas-fired capacity resources utilizing multiple technologies that

provide economy, flexibility, environmental compatibility, and reliability. Resource

selections include flexible reciprocating gas-fired engines, a high thermal efficiency

combined cycle combustion turbine with duct firing, and low capital cost simple cycle

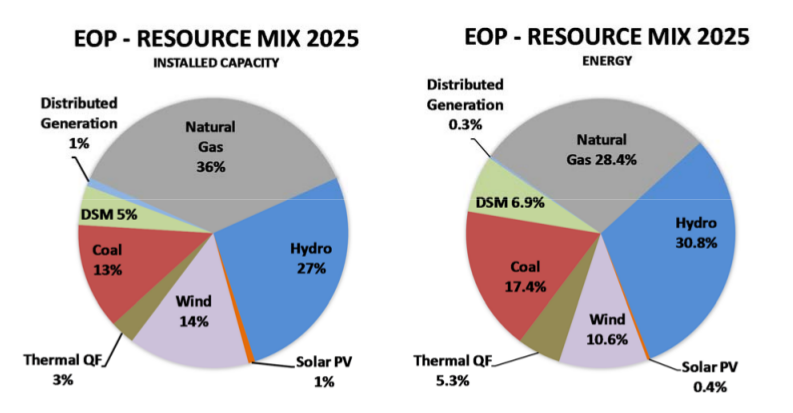

combustion turbines (Table 1-2). When added to the existing portfolio, the resulting

combination of multiple gas-fired technologies, hydroelectric, thermal, wind and limited

solar sources creates a cost-effective and diverse portfolio with the capability to deliver

sustainable and needed levels of resource reliability and adequacy while further reducing

an already low carbon emission footprint (Figure 1-2). Compared to the market alternative,

the 20-year NPV of portfolio cost for the EOP is roughly 7% lower:

▶ EOP $5.5 billion

▶ Current Portfolio + Market $5.9 billion

Table 1-2 EOP Resources

Optimal capacity expansion planning evaluated whether wind and solar photovoltaic

(“PV”) resource options could contribute to meeting winter peak demand. In the case of

both solar PV and wind generation, neither resource was determined to be an economic

alternative to gas-fired generation options because of low (including zero) capacity

contribution, inability to dispatch, and resource cost. Renewable energy resources such as

wind and solar PV are not an economically viable alternative to capacity resources which

have the capability to meet time sensitive load-serving needs.

Figure 1-2 EOP– Resource Mix 2025

The 2015 Plan identifies needs over a 20-year planning horizon and evaluates how these

needs can be best satisfied using proven and reliable natural gas-fired generation

technologies. Siting gas-fired generation on the Montana natural gas transmission system

will require a comprehensive evaluation of infrastructure alternatives. The development

of natural gas transportation infrastructure is a particularly critical component of the EOP

strategy since it will ultimately determine where and when new generation resources can

be added.

ddd